Featured News

-

Help us Celebrate National FFA Week Feb. 21-28, 2026, and Give FFA Day on Feb. 26, 2026

NAU Country and the QBE Foundation proudly support National FFA Week and GIVE FFA DAY (Feb. 26, 2026). Our partnership and sponsorship with the National FFA Foundation help set future farmers up for success. NAU Country is committed to serving and supporting FFA in the many years ahead! February 20, 2026 -

NAU Country Leaders Bill Wilson and Jim Korin Honored at NCIS Conference

NAU Country is proud to announce that two of its respected leaders, Bill Wilson and Jim Korin, were recognized with prestigious awards at the National Crop Insurance Services (NCIS) Conference, honoring their outstanding contributions to the crop insurance industry. February 20, 2026 -

Supplemental Disaster Relief Program (SDRP) Stage Two Enrollment and Agent Information Session

The USDA FSA is providing over $16 billion in Congressionally approved assistance through the SDRP. Enrollment for Stage Two began on November 24, 2025, and will remain open until April 30, 2026. To support this process, the Risk Management Agency (RMA) and FSA will host an informational session (webinar) for crop insurance agents on Thursday, December 4, 2025, at 10:00 a.m. (EST). December 03, 2025

-

USDA temporarily suspends debt collections, foreclosures, and other activities on farm loans

Due to the national public health emergency caused by coronavirus disease (COVID-19), the U.S. Department of Agriculture announced the temporary suspension of past-due debt collections and foreclosures for distressed borrowers under the Farm Storage Facility Loan and the Direct Farm Loan programs administered by the Farm Service Agency (FSA) February 10, 2021 -

USDA announces implementation improvements of Livestock Risk Protection (LRP) Insurance Program

The U.S. Department of Agriculture’s (USDA) Risk Management Agency (RMA) announced that further changes to its Livestock Risk Protection (LRP) insurance plan will take effect on January 20 for crop year 2021 and succeeding crop years. January 22, 2021 -

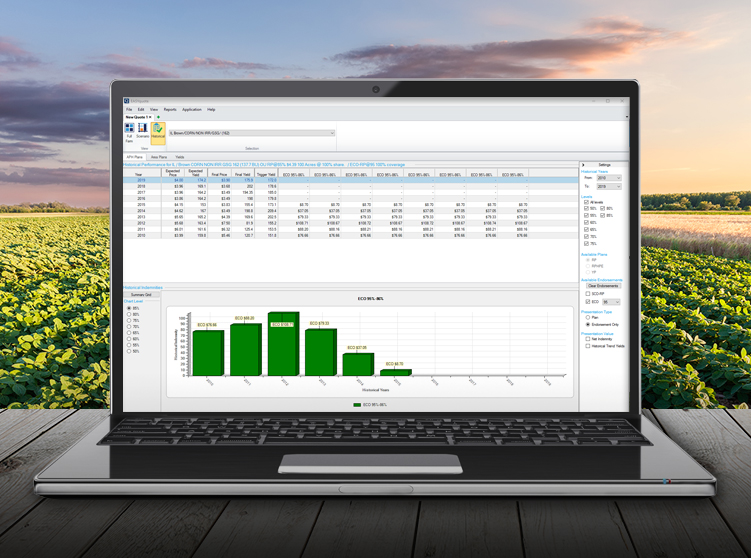

Is the Enhanced Coverage Option (ECO) right for you?

NAU Country’s drive and focus to deliver risk management solutions for the American Farmer has led to the development of the new Enhanced Coverage Option (ECO). Now, we need to know if it's right for you! Our quoting system offers accurate ECO quoting on your insured's policy, the ability to view their Individual APH and how it correlates to county values, and analyze "what if" indemnity loss performance in the Historical Analyzer. We also provide a surplus of sales tools including an ECO brochure, product overview, and radio and print ad templates. January 21, 2021 -

NAU Country offers the Enhanced Coverage Option (ECO)

The Enhanced Coverage Option is an area-based supplemental shallow-loss coverage that covers loss from 86% up to 90% or 95%. The endorsement is offered on 31 crops for the 2021 crop year, with expansion planned for 2022. Talk to your Marketing Representative today! November 19, 2020 -

NAU Country leads the development of Enhanced Coverage Option (ECO) to Help American Farmers Further Protect Their Crops

NAU Country Insurance Company and Watts and Associates, Inc., collaborated on a new crop insurance product titled the Enhanced Coverage Option (ECO). ECO is simply an area-based supplemental shallow-loss coverage that covers loss from 86% up to 90% or 95%. It is expected to be available on over 30 crops beginning in 2021 with more to follow in 2022 and beyond. October 12, 2020 -

Field Insights® fresh new look and feel to map components

NAU Country's flagship farmer tool Field Insights® has a new look and feel on several map component features. These new changes come accompanied by the same reliable data and useful information that is available at all times to our farmers and agents. Take a peek at the updated look for Field Conditions – Planting Conditions and 10-Day Forecast, Spray Advisor, Soil data, and Historical Weather tools. October 01, 2020 -

2021 NAU Country Photo Calendar Contest

We are gathering photos from the farm in preparation for our 2021 NAU Country Photo Calendar. The theme for this edition is Fun on the Farm! That means any farm-related photos, we want to see - the funnier the better! July 30, 2020 -

USDA announces Livestock Gross Margin insurance program improvements

USDA’s Risk Management Agency (RMA) announced changes to the Livestock Gross Margin (LGM) insurance program for cattle and swine beginning in the 2021 crop year. July 24, 2020 -

RMA Update: COVID-19 FSA Acreage Reporting Date changes

Given the current situation surrounding COVID-19, the United States Department of Agriculture's (USDA's) Risk Management Agency (RMA) announced additional information on the FSA Acreage Reporting Date as well as Manager's Bulletin MGR-20-015 that was issued on May 28, 2020. July 13, 2020 -

USDA improves crop insurance policies with new options

The U.S. Department of Agriculture (USDA) today announced changes to several crop insurance policies improving options for producers, including introducing a new Quality Loss Option, a new unit structure assignment option for Enterprise Units (EU) and new procedures for Multi-County Enterprise Units (MCEU). July 13, 2020